by market analysts Stephen Platt and Mike McElroy

Price Overview

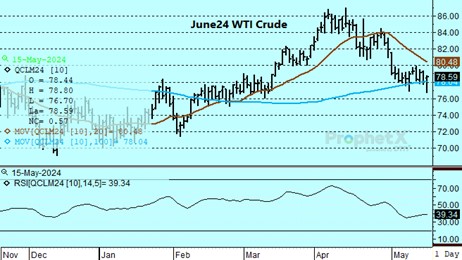

Crude oil traded on the defensive early but recovered to settle higher by 61 cents at 78.63. Selling was linked to the the IEA Monthly report showing subdued demand leading to a downward revision in their forecast for growth in 2024 to 1.1 mb. The report also noted continued gains in global inventories in March reflecting a sizable build in afloat barrels which was partially offset by a decline in OECD inventories which remain low. The IEA traced the weaker demand forecast to poor industrial activity and a mild winter in Europe and the US. A constructive DOE report, concern over Canadian wildfires affecting production, and signs of an imminent Israeli offensive in Rafah lead to short covering.

Key considerations included in the IEA Monthly report:

- Global oil demand expected to rise 1.1 mb/d in 2024 and 1.2 in 2025.

- World oil supply was projected to increase by 580 tb/d to a record 102.7 mb/d, with non-OPEC output rising 1.7 mb/d and OPEC production falling 840 tb/d assuming voluntary cuts are maintained through the end of the year. In 2025, total global output is expected at 1.8 mb/d.

- The weakness in global refinery margins undercut refinery throughput. Nevertheless, growth in refinery activity is to increase from 500 tb/d in the 2nd quarter to 1.8 mb/d in the 2nd

- Global inventories surged 34.6 mb in March due to a sharp increase in afloat storage, while on land stocks fell by 5.1 mb to their lowest level since 2016. Further increases in global stocks were noted in April.

The DOE report provided modest support, with commercial crude inventories falling 2.5 mb while gasoline stocks fell .2 and distillates were unchanged. Total stocks of crude and products rose by 3.5 mb as propane and other oils rose sharply. A strong increase in refinery utilization increased by 1.9 to 90.4 percent. Disappearance levels were 20.1 mb compared to 20.3 last week with, gasoline disappearance increasing to 8.9 mb. Net exports of crude and products totaled 1.7 mb/d.

Look for prices to work up to the 81.50 level basis June as concerns build over Canadian wildfires affecting crude production. The subdued CPI also provided relief to the market as the dollar and interest rates weakened. Caution is likely ahead of the OPEC meeting on June 1st, with expectations for voluntary production cuts of 2.2 mb/d being rolled over into the second half of the year, keeping stocks balanced.

Natural Gas

Prices managed to notch their sixth straight day with a new high for the move, as the June settled with a gain of 7.2 cents at 2.416 which marked the highest close since late January. Weather has helped keep the market on an upward trajectory. Although forecasts are showing demand near normal, recent revisions bringing heat into the South-Central region has trade wary of an early start to summer. Extended forecasts pointed to substantial heat for Texas in June to further embolden bulls. Production also saw a large drop to 95.2 bcf this morning after recovering to the 98 area over the weekend. That number likely gets revised upward but should still pull back from the recent highs. The upside target remains the gap on the charts at 2.702 from early January, with resistance near 2.44 and 2.49 on the way. Minor support should arise near 2.31 and then at the 9-day moving average now at 2.27. The weekly storage report is estimated to show a 77 bcf injection, below the average for this time of year at 90.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.