by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded on the defensive, settling $1.12 lower at 77.16 basis September crude. The weakness was surprising given the stronger than expected US second quarter GDP reported yesterday at 2.8 percent and additional moves by China to stimulate their economy. Wildfires in key Canadian shale production areas also failed to dissuade sellers. Instead, market participants focused on China and declining crude import levels as their economy grows slower than expected due to the property crisis which has affected consumer spending and sentiment. The potential for Chinese demand to slow further in the upcoming year as OPEC+ attempts to rollback production cuts is undermining sentiment at a time when seasonal demand is the strongest.

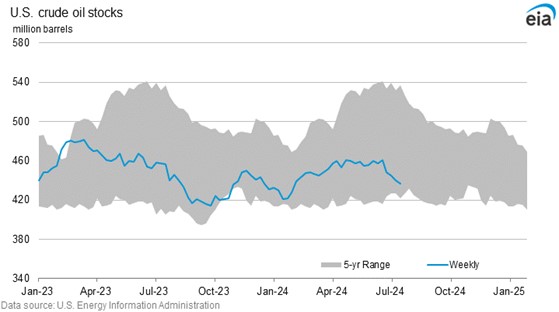

Despite the weakness today, the market is likely to stabilize near current levels. Crude stocks remain low relative to the five-year range in the US, and gasoline demand and consumer spending are buoyant. The market will remain cautious on the upside due to the possibility of stock increases later this year. Production by OPEC+ above established quotas will be monitored closely given promises from Russia and Iraq to compensate for excesses. With Iranian production increasing, further erosion in Saudi market share is possible and might prove to be problematic given their growing budget deficit. Subsequently, upside resistance near 81.00 could be formidable, particularly if margins remain weak as new refining capacity comes on stream from the Middle East and inventories rebuild later this year.

Natural Gas

Prices tested the contract lows over the last two sessions, trading down to 2.041 and settling with a loss of 2.1 cents at 2.051 on the September contract. Yesterday’s storage report was the catalyst for the additional weakness as the 22 bcf build was above estimates near 16. Forecasted heat next week has remained in the outlook, along with the improvement in LNG flows as supportive influences. These are battling against steady production levels and a resilient storage overhang that was 16.4 percent above the 5-year average after yesterday’s data. The search for a price level that reigns in production will likely have to breach the 2 dollar level, with the gap on the weekly chart down at 1.848 the next target. To turn the market around it will first need to settle convincingly throught the 2.15 area and then through resistance at 2.28 to target a bounce to the first retracement level at 2.473.

**The Energy Brief will be discontinued on July 26th.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.