by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded cautiously, with crude ending 41 cents lower at 82.21 despite early support provided by strength to equities and prospects for an interest rate cut in September. Indications of strong summer fuel demand remained in the background, with US gasoline demand reaching the highest level since 2019 at 9.4 mb/d for the week ended July 5th. Concern over Chinese demand remained a bearish backdrop to values following reports crude oil imports fell 11 percent in June.

The Chinese situation was highlighted in the monthly IEA report as their status as a driver of global demand growth fades and increased energy efficiency and the rise of electric vehicles leads to slower demand and possible stock rebuilding in 2025.

Key aspects of the report included:

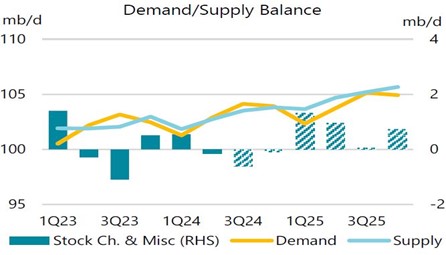

- World oil demand continued to decelerate, with 2nd quarter 2024 growth easing to .7 mb/d against last year and the slowest increase since 4th quarter 2022 as Chinese consumption contracted. Global gains are forecast to average below 1 mb/d in 2024 and 2025 as subpar economic growth and greater efficiencies and vehicle electrification function as headwinds.

- Despite a significant drop in Saudi flows, global oil supplies grew by 910 tb/d in the second quarter with further growth of 770 tb/d expected in the third quarter on non-OPEC increases totaling 600 tb/d. An annual increase of 777 tb/d is expected for 2024 and a gain of 1.8 mb/d in 2025.

- Global observed inventories rose for a fourth month in May, rising by 23.9 mb as offshore inventories fell by 17.3 mb/d but on land stocks rose by 41.3 mb to a 30-month high. In June global oil stocks are expected to fall by 18.1 mb.

Upside movement will be difficult despite support from the rising likelihood of an interest rate cut in September. Apprehension over OPEC production levels persists, limiting the effectiveness of the current agreement. Signs the US economy might be slowing along with concerns over the pace of growth in China and Europe will offer overhead resistance on ideas that inventory levels might not fall as much as expected in the third quarter.

Natural Gas

The market probed out new lows for the move each of the last two sessions, trading down to 2.249 basis August today before finding end-of-week short covering to close with a gain of 6.1 cents at 2.329. The after effects of Beryl continued to be digested, as demand destruction and LNG backups linger. Early estimates of 2.7 million people without power in Texas have improved, but as many as 1 million remain in the dark, while Freeport continues to be shut-in, with the running total of demand loss to the facility now over 11 bcf. Prices also suffered from a higher than expected stock build reported yesterday, with the 65 bcf injection well above estimates near 55. To excite trade into any sort of rally prices will first need to settle above the 9-day, which is currently near 2.37, and then challenge downtrend resistance in the 2.55 area. Contract lows are still within striking distance, so any significant downward revisions to demand expectations will lead to a quick test of the 2.208 level.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.