by market analysts Stephen Platt and Mike McElroy

Price Overview

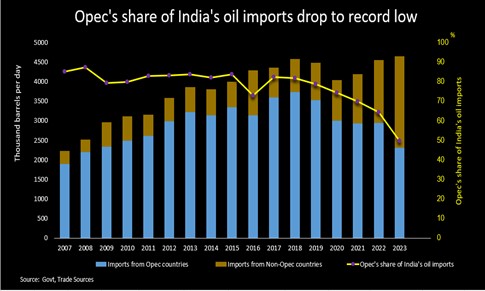

Crude oil settled 67 cents lower at 73.41. The market failed to follow through on early strength linked to missile exchanges between Western forces and Houthi’s in the Red Sea along with a battle between Pakistani forces and Iranian militants in Iran. Support was also apparent in response to the IEA forecast for an upward revision in 2024 demand growth in their January monthly report by 180 tb/d to 1.24 mb/d. The resistance above 74.00 was linked to ongoing concerns over Chinese demand and that despite higher freight rates supply availability has not been affected, with Russian exports expanding by 500 tb/d in December and market share continuing to erode for OPEC members on increases in production by non-OPEC suppliers and Iran, who is exempt from current production curbs. Of concern to members are altered trade flows and costlier shipments, which in the case of India has curtailed its intake of Middle Eastern crude as a share of its oil imports to the lowest rate ever.

Consensus is emerging that the Fed will step back from a rate cut this month on improving consumer sentiment and economic strength. Sentiment is the opposite in China, where talk of rising petrochemical demand has been overshadowed by rising freight rates affecting the cost of goods manufactured and exported.

The consolidation in the 70-76 range basis prompt crude is likely to persist. The market will watch for additional supply threats in the Middle East, but the concerns have moderated given that no key production areas have been threatened and questions persist over OPEC’s commitment to support prices amid concerns over demand. Production growth in areas outside of OPEC+ are also providing a headwind to values. Look for inventories to build modestly in 2024, limiting upside to the 76 area. Support should continue to emerge in the 68–70-dollar range basis March given curtailed production in Libya, action by OPEC in response to lower prices, the risk premium associated with Middle East tensions and the potential for an acceleration of SPR purchases by the US and other countries at prices below 70.00.

The DOE report released yesterday showed crude inventories falling 2.5 mb, gasoline up 3.1 and distillate increasing 3.1 mb. Total stocks of crude and products rose 2.8 mb. Refinery utilization fell to 92.6 percent, off .3 from last week. Total disappearance of products reached 19.9 mb compared to 19.6 last week, with gasoline disappearance unchanged and distillate disappearance increasing .2 to 3.6 mb. Net exports of crude and products totalled 2 mb compared to 1.4 mb last week.

Natural Gas

Selling pressure continued as the market weakened every day this week, with the February ending at 2.519 and the soon-to-be front month March losing 16 cents to settle at 2.252. Yesterday’s storage report added to the already negative tone. The 154 bcf draw, although above average for this time of year, was well below estimates near 164. Weather remained the primary constraining factor, with above normal temperatures in the forecast for the end of January and early February. In the background were longer term outlooks suggesting a mild end to winter. With six trading days left, the February contract has little hope of regaining substantial upside traction. In the absence of a change in weather patters, the March will likely continue lower near term and test support near 2.18 and possibly the contract low at 2.098 ahead of next weeks expected massive storage drawdown. If those levels can hold, there is enough winter left to create upside chances. The 2.40 level would be initial resistance on a recovery, followed by the 2.50-2.52 range.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.