by market analysts Stephen Platt and Mike McElroy

Price Overview

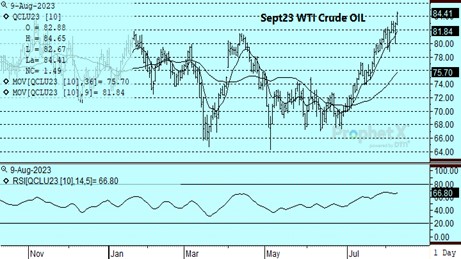

The petroleum complex saw solid gains today, with the September crude reaching a new high for the move at 84.65 before settling at 84.40 for a gain of 1.48. Scattered profit taking linked to a bearish DOE report along with growing concern over economic conditions in key consumers such as China and Germany eased values following the report, but they recovered into the close. Although the crude market continues to focus on tightness tied to voluntary production cuts of 1 mb/d from Saudi Arabia and the possibility that supplies will tighten on the heels of a soft landing to the US economy, it does appear other factors might begin to provide a headwind to values.

The DOE report showed crude inventories rising by 5.9 mb, with Cushing stocks up .1 to 34.6 mb. Gasoline stocks fell by 2.7 while distillates were off 1.7 mb. Total stocks of crude and products rose by 8.1, helping offset bullishness linked to last week’s report. Export levels fell sharply from last week, reaching only 2.4 mb/d while production levels showed a sharp increase to 12.6 mb compared to 12.2 mb last week. Disappearance levels were strong at 20.7 compared to 20.0 mb last week, with gasoline disappearance reaching 9.3 mb compared to 8.8 last week and 9.1 last year. Distillate disappearance was unchanged at 3.8 mb. Net exports of crude and products dipped to .3 mb/d compared to 3.1 last week. US crude exports will be watched closely in the weeks ahead given recent increases, with the 4-week average at 4 mb compared to 3.5 last year.

Despite the ability to shake off a negative DOE report, we are cautious of further strength beyond the 86.00 level. Although the US economy appears to be in good shape concern continues to build over the Chinese and German economies. Evidence that crude stocks have built in both India and China suggests their import demand might contract as prices for Russia crude increase. In addition, a recovery is underway in producing countries such as Iran, Libya, Venezuela, and Nigeria. The potential that they will take market share from countries that are currently limiting production might provide an incentive to back away from voluntary cuts which could ease supply tightness as we move through the fall.

Natural Gas

Prices continued to rally today as the September contract added 18.2 cents to settle at 2.959. The 3-dollar level was briefly tested with an intraday high achieved at 3.018. US fundamentals did not justify the gains, with the only positive influence being a dip in production of nearly 2 bcf due to maintenance. Technical buying and stops were triggered above 2.87 and again near 2.91 as a strong move higher in European prices helped propel US values. A potential strike by Australian LNG workers ignited supply fears that drove benchmark Dutch TTF prices higher by as much as 40 percent today. The recent volatility that has been lacking in this market for months may attract speculative interest in the coming days to further magnify gains. The March high near 3.50 is the next obvious target on the upside, which would also mark a 38 percent retracement of the sell-off since December. A retrenchment will find initial support in the 2.77-2.80 range. Estimates for tomorrow’s storage report indicate a 25 bcf injection compared to the 5-year average at 46.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.