by market analysts Stephen Platt and Mike McElroy

Price Overview

The petroleum complex traded with an upside bias as the market assessed demand prospects against potential supply. Credit concerns related to a property developer in China created uncertainty with respect to demand for the remainder of 2023 and into 2024 in the absence of government intervention to support the property sector.

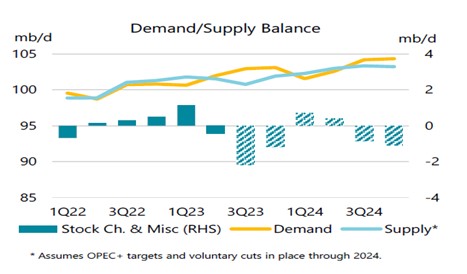

The IEA Monthly report released today continued to portray a rather tight supply/demand balance as it suggested that demand is scaling record highs boosted by strong summer air travel, increased oil use in power generation and surging Chinese petrochemical activity. The Agency suggested global demand will expand by 2.2 mb/d in 2023 to 102.2 mb/d with China accounting for 70 percent of the growth. In 2024, growth is expected to slow to 1 mb/d on sluggish economic conditions, tighter efficiency standards and as new electric vehicles weigh on demand. On the supply side, total crude production slid .9 mb/d to 100.9 due to the Saudi output cuts. For OPEC+, global supply fell by 1.2 to 50.7 mb/d while non-OPEC+ volumes increased 310 mb/d with global supply growth expected to expand 1.5 mb/d in 2023. Russian oil exports held steady at 7.3 mb/d with exports to China and India accounting for 80 percent of that total.

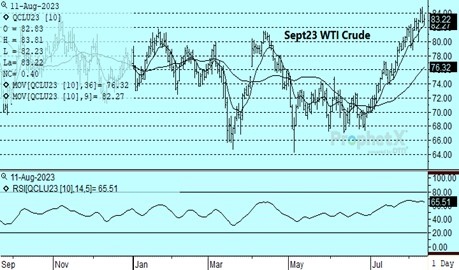

Although the crude market continues to focus on tightness tied to voluntary production cuts from Saudi Arabia and the possibility that supplies will tighten on the heels of a soft landing to the US economy, it does appear the deficit forecast in the 3rd and 4th quarter of this year has been priced in as other factors might begin to provide a headwind to values.

The US economy appears to be in good shape, but concern continues to build over the Chinese and German economies. Evidence that crude stocks have built in both India and China suggests their import demand might contract as the price of Russia crude increases. In addition, a production recovery is underway in Iran, Libya, Venezuela, and Nigeria. The potential that they will take market share from countries that are currently limiting output might provide an incentive to back away from voluntary cuts, which could ease supply tightness as we move through the fall.

Natural Gas

Wednesday’s gains were quickly erased as the market lost 19.6 cents yesterday and followed that up with a small gain today to end the week at 2.770 basis September. Prices had started to retreat early yesterday as the initial reaction to potential strikes by Australian LNG workers was overextended with a final decision not yet reached by the unions there. The weekly storage report added to the change in tone as the 29 bcf build was above estimates near 25. Underlying support continues to be offered by weather forecasts that remain well above normal in the 15 day outlooks. A drop of 5 gas rigs in the Baker Hughes report today offered minor support into the close as trade awaits signs of slowing production from the steadily decreasing count. The 9-day moving average near 2.69 was tested today and marks key support on the downside. A settlement below there could lead to a quick test of the 2.60 area. With the upside cleared out over the last two sessions, initial resistance should surface at 2.87 without much above there until 3 dollars.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.