MORNING COMMENTS

Ag Fundamentals:

November beans rejected at the 20-day moving average($10.11) and also closed below the 100 day moving average ($10.07). Some producers may have been caught on their heels this month with first notice day being Thursday next week. The Nov/Jan bean spread event may have been a handful of large positions caught short. Hard to say if the parties involved have exited those positions completely, but we will see more movement out of the November futures today through Wednesday next week. Bean options expiration is today. Many are looking at the lack of news and slow start to the trading day as sign that fireworks may wait until the final hour of trading today. corn had a strong week with better than expected ethanol production and better than expected exports. Corn exports were mostly to Japan and Mexico, sizable Mexico business being fairly typical this time of year.

Weather:

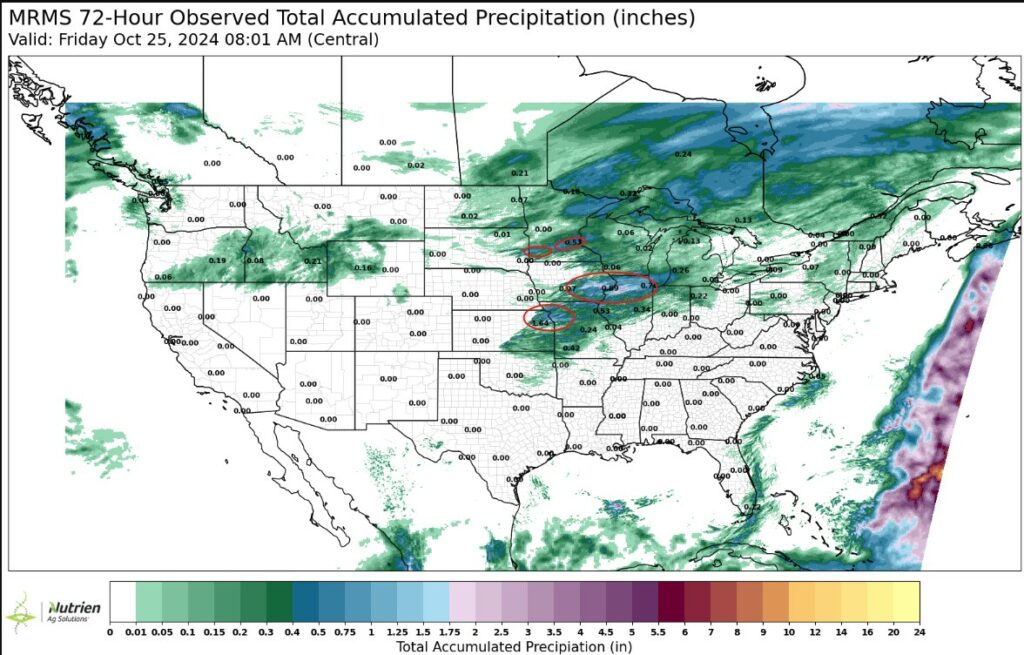

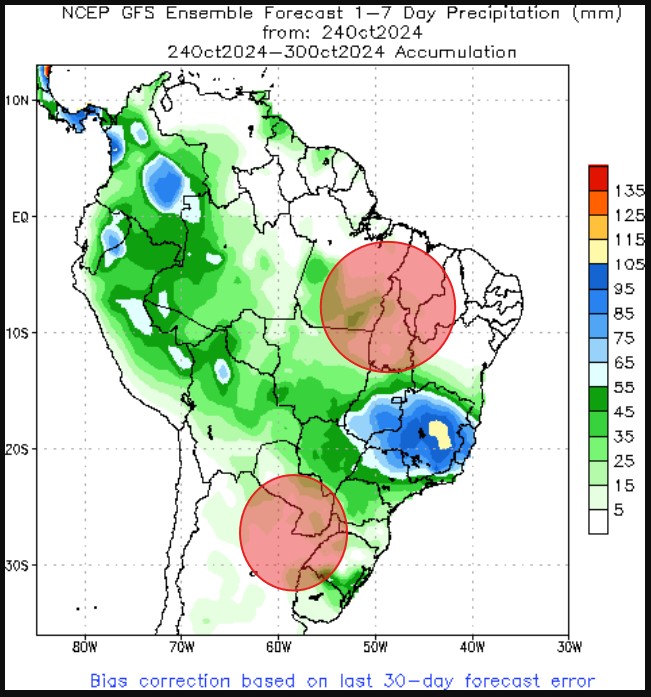

It rained in eastern Iowa, southern Minnesota, and northern Illinois. Farmers in these areas are pleased to see rain for both their soil health and to give them a well-deserved breather from a non-stop harvest. Rain is expected to come through the central regions of Brazil in the next 7 days. There is some dryness developing in the northern and southern growing regions.

Areas Circled in Red are where the farmers finally have the morning off to sip some coffee, after weeks of little to no rain pausing operations.

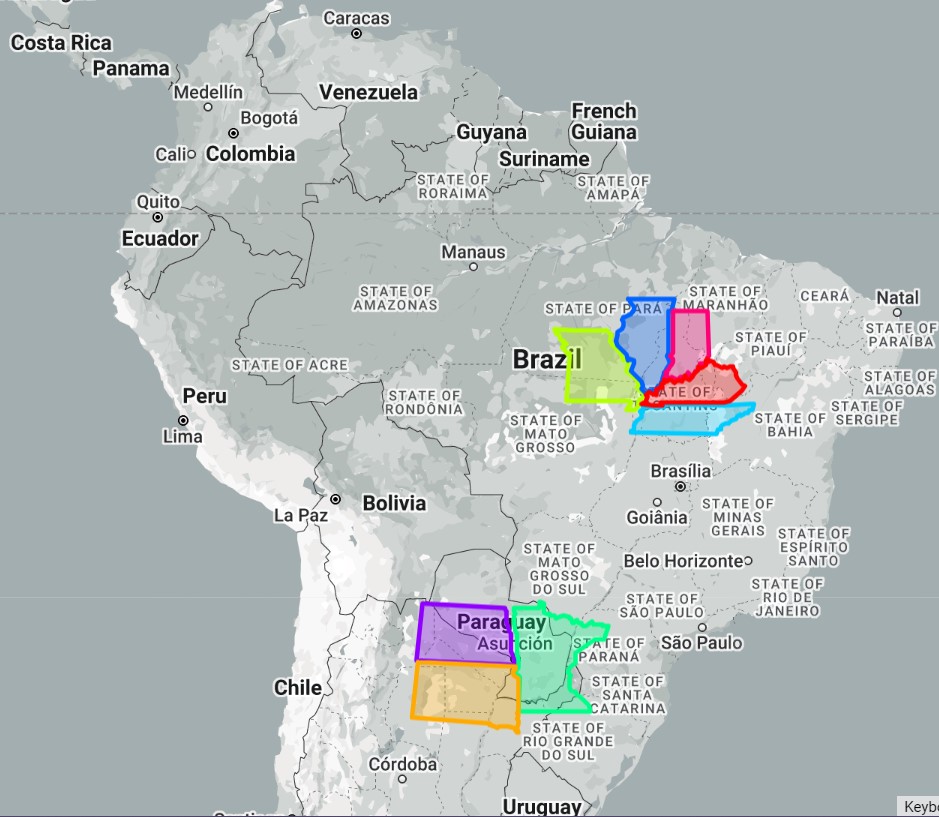

Brazil’s 7-Day Total Precipitation Forecast shows there are two areas that may start to raise some concern of dryness. The area that covers can be seen with comparisons to US states below.

Export & World News

277K MT of US corn was sold to Japan and 165K Mt of corn to unknown buyers. Unknown buyers also bought 198K MT of soybeans from the US. Iran purchased 120K MT of corn. Jordan is looking for 120K MT and Bangladesh is looking for 50K MT of milling wheat.

Malaysian palm oil futures were down 70 ringgit overnight, at 4533.

>>Interested in more commentary by Joe Mauck? Go HERE

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.