by market analysts Stephen Platt and Mike McElroy

Price Overview

Crude oil continued to trade on the defensive with values settling off 84 cents at 78.11, the lowest since mid-March. The weaker tone reflected the potential for a cease fire in Gaza along with the recent build in inventory levels in the US and Europe. A workshop convened today bringing together Iraq and Kazakhstan to address their exceeding of quotas. Iraq overproduced by 602 tb/d while Kazakhstan was in excess by 389 tb/d during the first quarter. Navigating this issue will be a key consideration at the June 1st OPEC+ meeting to discuss whether voluntary production cuts of 2 mb/d will be extended. The payroll report, which led to strong gains in the equity markets, failed to support crude to any measurable degree despite raising the probability of an interest rate cut in September.

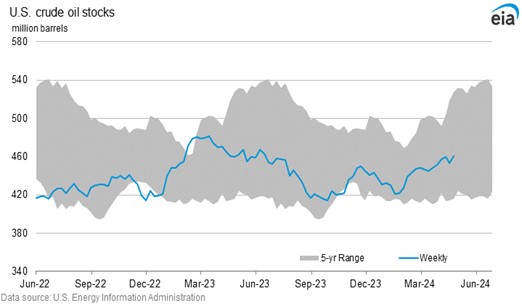

Inventory levels will be a key consideration for OPEC+ given the divergence of forecasts for demand growth, with OPEC at 2.2 mb and the IEA at 1.2. The sharper than expected increase in US inventories this past week reflected sluggish demand and high production. The 100-day moving average at 77.56 is a key area of support, with a pick-up in demand and stock declines during the summer if the cuts remain in place providing stability to the market.

Natural Gas

The market made a quick swing higher and back through its recent range to end the week, gaining over 10 cents each of the last two sessions. Today’s settlement at 2.142 was the highest since early March. The recovery started in the wake of the weekly storage report showing a 59 bcf build. The number was above estimates and not particularly bullish, but values improved following the release none the less. Today saw an announced force majeure at mid-morning by NGPL on a compressor station in Texas due to flooding issues. Prices had an oversized reaction as stops in the 2.07 to 2.10 range were flushed out and pushed the market to its highs. Whether the momentum can carry over next week remains to be seen as fundamentals across the board remain negative. Continuation higher will find minimal resistance until the 100-day moving average at 2.25. Support on a turn back to the downside will be spotty until the 2-dollar area.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.