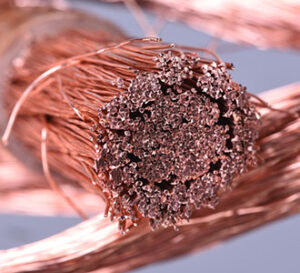

COPPER

In retrospect, the copper market initially managed to take another round of soft Chinese data in stride and in fact posted higher highs afterward. However, a very definitive reversal was forged early this week in a market that was massively overbought in spec and fund categories. While a sustained holiday in China might have allowed a portion of this week’s selloff and it is possible Chinese buyers came off the bench on the slide below $4.50 yesterday, fear of softening Chinese copper demand remains a feature in the trade. We suspect optimism from global equities and a downside breakout in the dollar have also added to the market’s rejection of probes below $4.50 this morning. However, in addition to the net spec and fund long positioning reaching extreme overbought levels, news that Chinese producers may be planning to export 100,000 tonnes of copper certainly added fuel to this week’s liquidation pattern and that should remain a residual headwind for copper prices.

GOLD & SILVER

With a downside breakout in the dollar index overnight to the lowest level since April 12th, a portion of the bear camp should be discouraged. However, gold has clearly established a pattern of lower highs and remains within the lower quarter of the range of the last 30 days in a fashion that favors the bear camp. Furthermore, gold ETF holdings yesterday declined by a VERY significant 193,328 ounces for a 0.2% daily decline, with silver ETF holdings declining by 4.3 million ounces in the last two days. So far, widespread, and sometimes violent protests in favor of Hamas at US universities has added light flight to quality interest but that issue has not become an important feature of the daily gold and silver trade yet. In fact, today’s focus will likely hinge on the US monthly payroll reading which in turn will impact market perceptions of the direction of US Fed policy and influence the direction of the US dollar trade. Nonfarm payrolls are expected to be moderately lower than last month but still in a healthy growth range. Therefore, the bull camp will need soft US data to respect key support as a strong reading could shift the pendulum back in favor of a rate hike. On the other hand, it is possible that weakness early in the session will attract bargain hunting buyers later today from those looking to position ahead of a possible weekend flareup in Middle East tensions. However, despite the massive drop in gold and silver prices, the net spec and fund long positions likely remain burdensome and capable of further stop loss selling from violations of key charts support levels.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.