by market analysts Stephen Platt and Mike McElroy

Price Overview

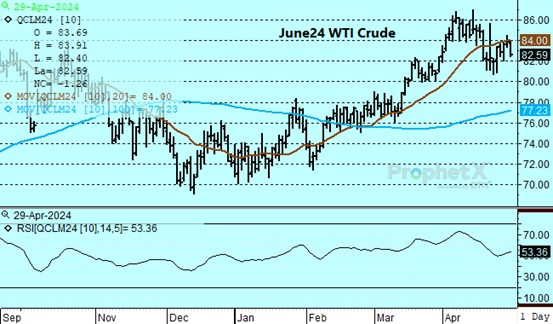

The possibility of a cease-fire in Gaza and nervousness ahead of the Fed policy meeting that begins tomorrow put pressure on crude, with the June settling lower by 1.22 at 82.63. In the background was a stronger dollar which could adversely affect overseas demand due to higher prices for petroleum products in local currencies. A Hamas delegation will visit Cairo today for talks aimed at securing a ceasefire. The Fed meeting is not expected to see any change in interest rates but might provide insights on how quickly rates decline if at all given the recent increases in inflation to 2.7 percent annually verses the 2.0 percent target of the Federal Reserve.

Despite geopolitical uncertainty in the Middle East and possible disruption of supplies, the market will be impacted by the underlying supply/demand situation. Inventories in Europe have built recently while afloat inventories have come down. There is still a belief that the market is well balanced as it continues to maintain modest trading ranges. Demand. particularly from China and India, will be watched closely for signs of growth in global consumption and the possibility for tightness later this year. Reports that Saudi Arabia may raise their OSP’s in June for Arab Light crude on supply tightness due to OPEC+ cuts and strong margins could limit downside price movement.

The DOE report is expected to show crude inventories fell by .8 mb while gasoline and distillate are expected to fall by 1.0 and .5 mb, respectively. Refinery utilization is expected to increase by .5 to 89.0 percent.

Although a cease fire might undercut values, potential for increasing tensions should offer underlying support to values near the 82.00 level with potential to test the 86.00 area basis June as the market assesses the inventory situation along with economic trends.

Natural Gas

Staying true to recent form, the natural gas bounced off the lows and appears headed for a retest of the upper end of its recent range between 1.90 and 2.15. Signs of recovery at Freeport once again sucked in the bulls, as they took in .3 bcf yesterday and .8 in early nominations today. The next few sessions will determine whether this is another head fake or if trains are actually coming back online. Production crept down toward 96 bcf/d over the weekend to add support. Today’s gain of 10.7 cents and settlement at 2.03 basis June pushed back above the 9 and 20-day moving averages. If Freeports’ gains are maintained, minor resistance near 2.10 will likely give way to a quick test of the 2.15 area. Support moves up to the 2 dollar level and then at the lows near 1.90.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.