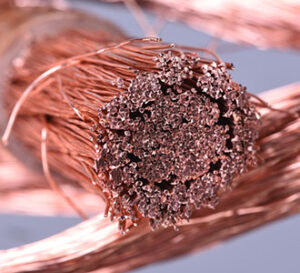

COPPER

The copper market has clearly reversed and strongly rejected yesterday’s new high for the move in a fashion that shifts control back to the bear camp. In fact, short-term technical indicators have shifted into sell modes which in turn have completely overshadowed news that Chinese copper imports increased last month. Chinese January through October concentrate imports were 22.6 million tons versus 20.7 last year. Furthermore, October Chinese copper concentrate imports were 2.31 million tons versus only 2.24 million tons in the prior month and month over month. Furthermore, Chinese wrought copper and copper product imports expanded. However, countervailing the strong concentrate import figures were lower January through October brought unwrought and product imports.

GOLD / SILVER

Gold has been a one-way bearish trade the entire overnight session as traders seem to be unwinding long positions on the back of weaker than expected Chinese data and an ongoing bounce in the dollar. Some of the normal bullish gold catalysts have been completely discounted. Furthermore, Benjamin Netanyahu announced that Israel will now take ‘indefinite’ control over Gaza, and that has failed to give support to gold prices. On the bullish side, China recorded a record gold holding this month with 71.2Mn ounces. What makes this data unique is the fact that Chinese FX reserves dropped sharply over the past three months, which normal signals weaker gold demand, as they dollar-cost-average their holdings. In short, China is now expanding gold reserves, even despite smaller total FX reserves. While the Diwali festival starts early next week, and that might provide a potential uptick in India jewelry demand initial predictions by Indian jewelry dealers projected soft demand. However, those soft demand predictions were heavily predicated on expensive pricing and further price declines could entice Indian buyers. While US yields have come down significantly recently, very hawkish comments from the Fed’s Cook and Kashkari heavily offset last Friday’s lukewarm employment situation report.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.